The Union Budget 2025, presented by Nirmala Sitharaman on February 1, 2025, introduced one of the most taxpayer-friendly changes in recent years. The headline announcement was clear: income up to ₹12 lakh per annum is effectively tax-free under the new tax regime, and up to ₹12.75 lakh for salaried individuals after factoring in the standard deduction.

With no changes to the old tax regime, Budget 2025 firmly shifts attention to the revised slabs under Section 115BAC of the Income Tax Act, administered by the Income Tax Department (https://www.incometax.gov.in). The objective is simple—reduce tax burden, simplify compliance, and increase disposable income, especially for the middle class.

This article breaks down the new income tax slabs, explains who benefits the most, and outlines what it means for tax planning in 2025.

Big Picture: What Budget 2025 Means for Taxpayers

Budget 2025 is not just a routine rate adjustment. It reflects the government’s long-term intent to simplify taxation through slab rationalisation rather than exemptions, nudging taxpayers toward the new regime.

Key Takeaways

-

Tax-free income up to ₹12 lakh under the new regime

-

₹12.75 lakh tax-free for salaried individuals due to standard deduction

-

Old tax regime slabs remain unchanged

-

Clear focus on easing the tax burden for the expanding middle class

These measures were detailed in the Union Budget documents released by the Ministry of Finance (https://www.finmin.nic.in).

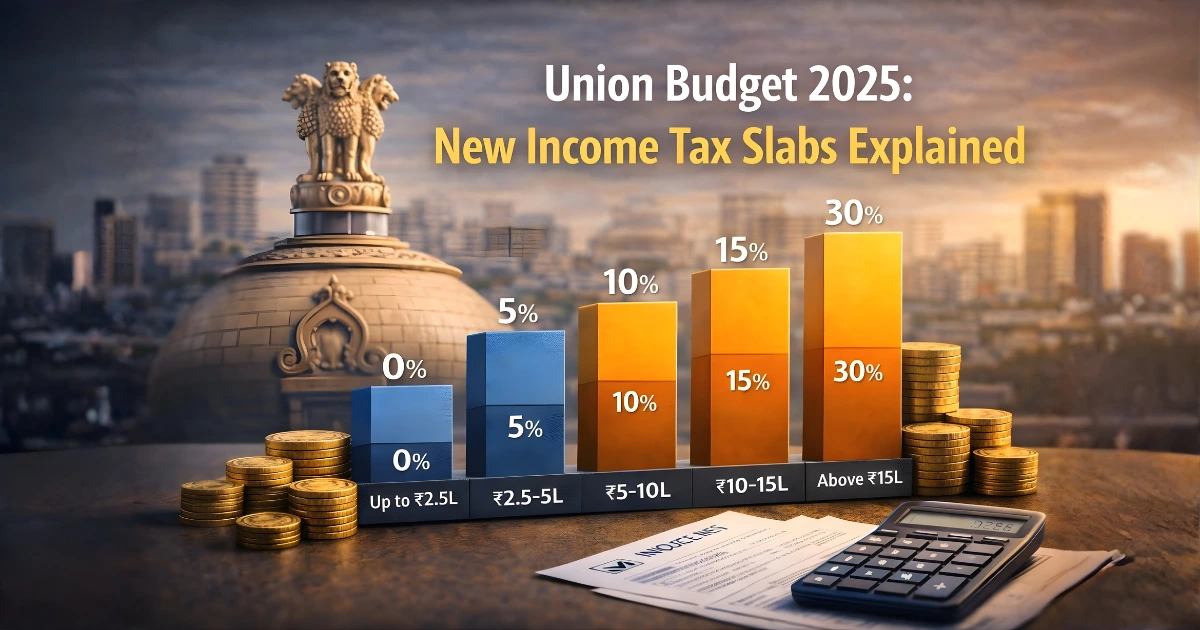

Revised Income Tax Slabs Under the New Tax Regime (Section 115BAC)

Budget 2025 proposed revised slab rates under Section 115BAC, applicable to individuals opting for the new tax regime.

Income Tax Slabs for FY 2025–26 (AY 2026–27)

| Total Income per Annum | Tax Rate |

|---|---|

| Up to ₹4,00,000 | Nil |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

These slabs significantly widen the zero-tax and lower-tax bands, offering meaningful relief to middle-income earners.

Official slab details are available on the Income Tax portal and Budget Memorandum.

How Income Up to ₹12 Lakh Becomes Tax-Free

Although tax is calculated progressively, rebate provisions under Section 87A ensure that individuals earning up to ₹12 lakh pay zero tax under the new regime.

For Salaried Taxpayers

-

Standard deduction of ₹75,000 (retained under the new regime)

-

This pushes the effective tax-free income to ₹12.75 lakh

This is among the largest direct tax relief measures announced in the last decade.

No Change in Old Tax Regime: What That Means

Budget 2025 left the old tax regime untouched.

This means:

-

Deductions under Sections 80C, 80D, HRA, LTA, home loan interest, etc., continue

-

No new benefits or slab changes introduced

The implication is clear—taxpayers must now actively compare deductions versus slab benefits, rather than defaulting to the old regime.

Who Benefits the Most from Budget 2025 Tax Changes?

Middle-Class and Salaried Individuals

Budget 2025 is clearly structured to benefit:

-

Salaried professionals

-

First-time taxpayers

-

Individuals with limited deductions

Higher take-home pay directly boosts household consumption.

Young Professionals and New Earners

With income up to ₹4 lakh fully exempt and gradual slab progression thereafter, young earners face minimal initial tax pressure, encouraging early workforce participation.

Resident Individuals Under Section 115BAC

Any resident individual opting for Section 115BAC benefits from:

-

Lower effective tax rates

-

Simpler compliance

-

Minimal documentation

This is especially attractive for taxpayers without housing loans or heavy tax-saving investments.

Impact on Disposable Income and the Economy

Lower personal tax outgo translates into:

-

Increased spending power

-

Higher savings and investments

-

Stronger demand across consumption-led sectors

According to Budget projections released by the Ministry of Finance, gross tax revenue is still expected to grow by 11% over revised estimates for FY 2024–25, driven by wider compliance rather than higher rates.

How to Choose Between Old and New Tax Regime in 2025

Choose the New Regime If:

-

You claim minimal deductions

-

Your income is below ₹15–16 lakh

-

You want simpler tax filing and fewer documents

Stick to the Old Regime If:

-

You fully utilise 80C, 80D, HRA, home loan interest

-

You have significant long-term tax-saving investments

For most taxpayers, the revised slabs tilt the balance in favour of the new regime.

Broader Budget 2025 Context

Beyond income tax, the Union Budget 2025 emphasises agriculture, infrastructure, and middle-class consumption. Personal tax relief is part of a broader growth strategy aimed at boosting domestic demand while maintaining fiscal discipline.

Detailed policy context is available through official Budget publications and parliamentary documents.

Final Thoughts: A Taxpayer-Friendly Budget

The impact of Union Budget 2025 on income tax slabs in India is decisively positive for a large segment of taxpayers. With tax-free income up to ₹12 lakh, simplified slabs, and transparent rules, the new tax regime sets a fresh benchmark for personal taxation.

While the old regime remains relevant for deduction-heavy taxpayers, Budget 2025 marks a clear shift toward simpler, lower-tax compliance, boosting confidence, consumption, and long-term economic growth.