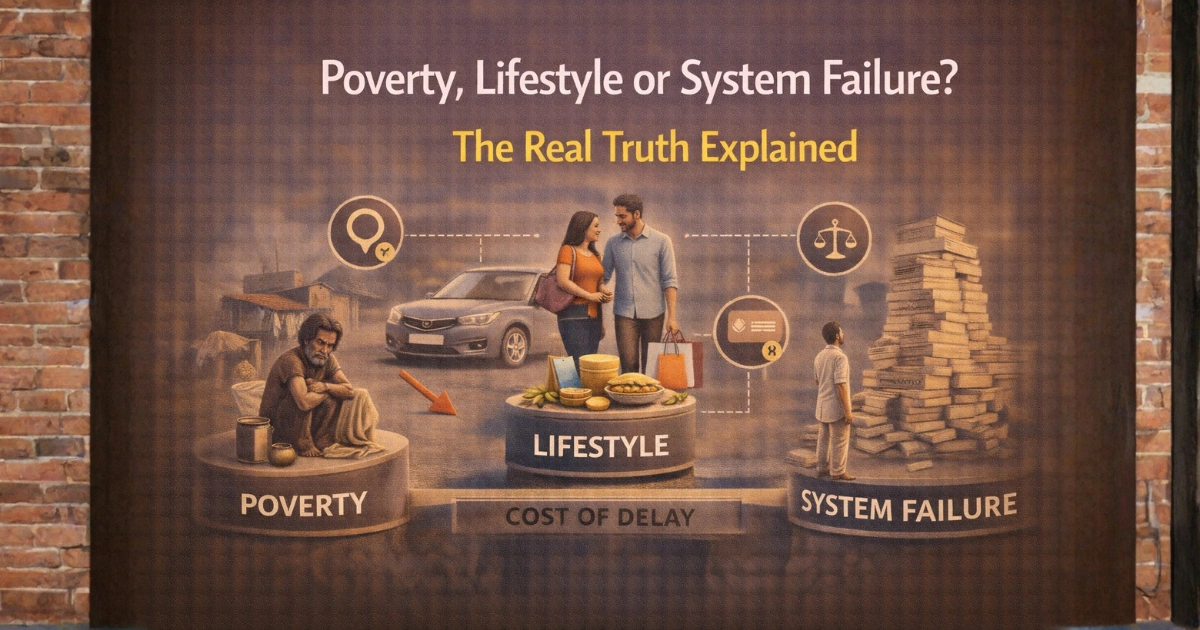

We’re often told that people are poor because they “don’t work hard enough,” or because they make bad financial choices. On the other side, some believe poverty is purely the result of broken systems, unfair economies, and circumstances outside a person’s control.

The truth lives somewhere in between.

Yes — lifestyle choices like overspending, poor habits, and lack of planning can hold people back. However, low wages, unemployment, systemic discrimination, lack of affordable housing, education, and healthcare — along with the weight of generational poverty and limited opportunity — can also play a powerful role. These themes are consistently highlighted in research by the World Bank on global poverty drivers:

👉 https://www.worldbank.org/en/topic/poverty/overview

Money struggles rarely have a single cause. Instead, they grow from a mix of personal behavior, social environment, and economic reality.

This article isn’t about blame. Rather, it’s about understanding the full picture — so you can recognize what’s within your control, and what isn’t.

Therefore, let’s break down how lifestyle, mindset, and systems intersect — and how small, intentional shifts can slowly move you toward stability.

Lifestyle Inflation — When Progress Turns Into Pressure

Lifestyle inflation happens when expenses grow as fast as — or faster than — income.

You get a raise, so you upgrade your phone.

You land a better job, so you move to a costlier neighborhood.

You start earning more, and “wants” slowly become “needs.”

This pattern is widely discussed in personal-finance research, including insights from Investopedia’s guide on lifestyle inflation:

👉 https://www.investopedia.com/terms/l/lifestyle-inflation.asp

Nothing feels reckless. Nevertheless, month after month, the numbers stop adding up.

Instead of building savings or investing for the future, every increase in income gets absorbed into lifestyle upgrades.

The result? You feel stuck — even when you’re earning more than ever before.

Lifestyle inflation doesn’t make people irresponsible. Rather, it happens because we adapt quickly to comfort and social expectations — a tendency explained in behavioral-economics studies on hedonic adaptation:

👉 https://www.behavioraleconomics.com/resources/mini-encyclopedia-of-be/hedonic-adaptation/

However, when lifestyle grows faster than income, financial stress quietly follows behind it.

Poor Spending Decisions — When Small Choices Add Up

Most financial problems don’t come from one big purchase. Instead, they develop from repeating patterns:

-

impulse spending

-

emotional shopping

-

“I deserve this” treats that become routine

-

subscriptions you never use

-

convenience spending that replaces planning

Individually, none of these feel dangerous. Together, however, they slowly weaken financial stability.

Here, lack of financial literacy plays a major role — something repeatedly highlighted in OECD financial-literacy reports:

👉 https://www.oecd.org/financial/education/

Many people were never taught:

-

how budgets work

-

how interest builds on debt

-

how credit cards really function

-

why saving early matters

-

how investing creates long-term security

Without that knowledge, money doesn’t feel like a system. Instead, it feels like chaos.

And ultimately, chaos is expensive.

Mindset — The Invisible Force Behind Money Habits

Mindset quietly shapes financial behavior long before money enters the picture.

If you grow up around scarcity, fear, or instability, you may develop habits such as:

-

living day-to-day instead of planning

-

avoiding long-term goals because the future feels uncertain

-

believing wealth “isn’t for people like you”

-

feeling powerless in financial situations

Research on scarcity mindset from Harvard Business Review explains how poverty-related stress reshapes decisions and behavior:

👉 https://hbr.org/2016/03/how-poverty-changes-your-mind-set

On the other hand, some people overspend because money becomes a coping tool — a way to escape pressure or feel socially equal.

Mindset doesn’t cause poverty. Nevertheless, it strongly influences how someone responds to financial pressure.

Shifting mindset takes time, patience, and exposure to better tools — not judgment.

When It’s Not About Lifestyle — The Reality of Structural Barriers

Not everyone is struggling because of habits or mindset. For millions of people, the biggest drivers of financial hardship are systemic — a theme reflected across United Nations inequality and development reports:

👉 https://hdr.undp.org/inequality

Low Wages and Unemployment

You can work hard — even work multiple jobs — and still struggle when wages don’t match living costs. The International Labour Organization’s wage reports show how stagnant incomes create long-term financial vulnerability:

👉 https://www.ilo.org/global/research/global-reports/global-wage-report

When income barely covers rent, food, and transport, there’s no margin for saving or “better decisions.” Survival leaves no buffer.

Lack of Affordable Housing, Education, and Healthcare

These three areas create some of the largest financial burdens:

-

high rent or relocation costs

-

education debt or limited access to quality schools

-

medical expenses that wipe out savings overnight

Studies from the World Health Organization reveal how medical debt pushes millions into poverty each year:

👉 https://www.who.int/news/item/29-11-2021-500-million-people-pushed-into-extreme-poverty-due-to-healthcare-costs

Even disciplined earners can fall behind when essential systems are expensive or unreliable.

Systemic Discrimination and Unequal Opportunity

Race, gender, geography, disability, and social class often influence:

-

hiring decisions

-

pay levels

-

access to networks

-

loan approval and credit terms

Inequality research from the OECD shows that structural barriers shape lifetime financial outcomes:

👉 https://www.oecd.org/social/social-mobility-2018.htm

Some people begin miles behind — not because of effort, but because of circumstance.

Generational Poverty — The Cycle Few Talk About

When poverty spans generations, children grow up:

-

without financial safety nets

-

without exposure to wealth-building habits

-

with limited access to opportunity

Research from the Brookings Institution explains how economic advantage — or disadvantage — compounds over time:

👉 https://www.brookings.edu/articles/intergenerational-mobility-and-poverty/

Breaking that cycle requires support, access, education, and time — not judgment.

The Honest Truth — Poverty Is Both Personal and Structural

Money struggles are rarely black-and-white.

Two realities can exist together:

-

lifestyle choices and spending habits can make situations worse

-

systemic inequities and economic barriers can make progress extremely difficult

Blaming everything on individuals ignores real-world barriers. However, blaming everything on systems removes personal agency.

The path forward sits in the middle — improving what you can control, while acknowledging the challenges you didn’t choose.

Action Steps — Building Stability One Step at a Time

You don’t need overnight transformation. Instead, you need direction.

Step 1 — Gain Awareness of Your Spending

Track where money actually goes. Even simple expense-tracking tools help. Here’s a basic budgeting introduction from NerdWallet:

👉 https://www.nerdwallet.com/article/finance/how-to-budget

Most breakthroughs begin with clarity — not restriction.

Step 2 — Focus on One Habit at a Time

-

reduce impulse spending

-

build a small emergency cushion

-

pay down high-interest debt first

Small wins create confidence. Gradually, confidence creates momentum.

Step 3 — Invest in Financial Literacy

Learn:

-

budgeting basics

-

debt management

-

saving and investing fundamentals

Free learning resources from the National Financial Education Network (India):

👉 https://www.nism.ac.in/financial-education/

Knowledge turns money from stress into strategy.

Step 4 — Seek Support, Not Shame

Community programs, financial counselors, mentors, and online learning platforms can all help. A useful directory of financial-counseling resources:

👉 https://www.financialcounselingassociation.org/

No one overcomes financial stress alone.

Common Mistakes to Avoid

-

treating lifestyle upgrades as progress

-

comparing your situation to people with different realities

-

assuming poverty is always someone’s “fault”

-

ignoring systemic barriers or personal responsibility

-

waiting for the “perfect time” to change habits

Progress is rarely linear — and that’s okay.

Pro Tips for Building Long-Term Financial Strength

-

live slightly below your means when possible

-

separate self-worth from possessions

-

build skills, not just income

-

challenge habits that drain your future

-

advocate for fair wages and better systems — because both matter

Personal responsibility and social change are not opposites. Instead, they work together.

Conclusion — Your Situation May Not Be Your Fault, But Your Next Step Is Your Power

Money struggles are complex. They’re shaped by behavior, mindset, opportunity, and systems larger than any one person. Even so, small changes can create momentum, confidence, and hope.

You may not control where you started — but you can influence where you go next.

Start with awareness. Build better habits where possible. Seek support. Question systems that hold people back.

And remember: financial progress is not about perfection — it’s about direction.

Take one step today — however small — toward stability, confidence, and a future with more choice.