The new rules of GST on e-invoicing have changed how Indian businesses issue and report invoices. What began as a...

The new rules of GST on e-invoicing have changed how Indian businesses issue and report invoices. What began as a...

Mandatory compliance for Indian startups and MSMEs in 2025 is no longer optional or paperwork-heavy—it is digital, structured, and closely...

Corporate taxation in India is a critical responsibility for every company operating in the country. From determining the right tax...

Running an NGO in India involves more than just social impact. Legal compliance plays a critical role in ensuring transparency,...

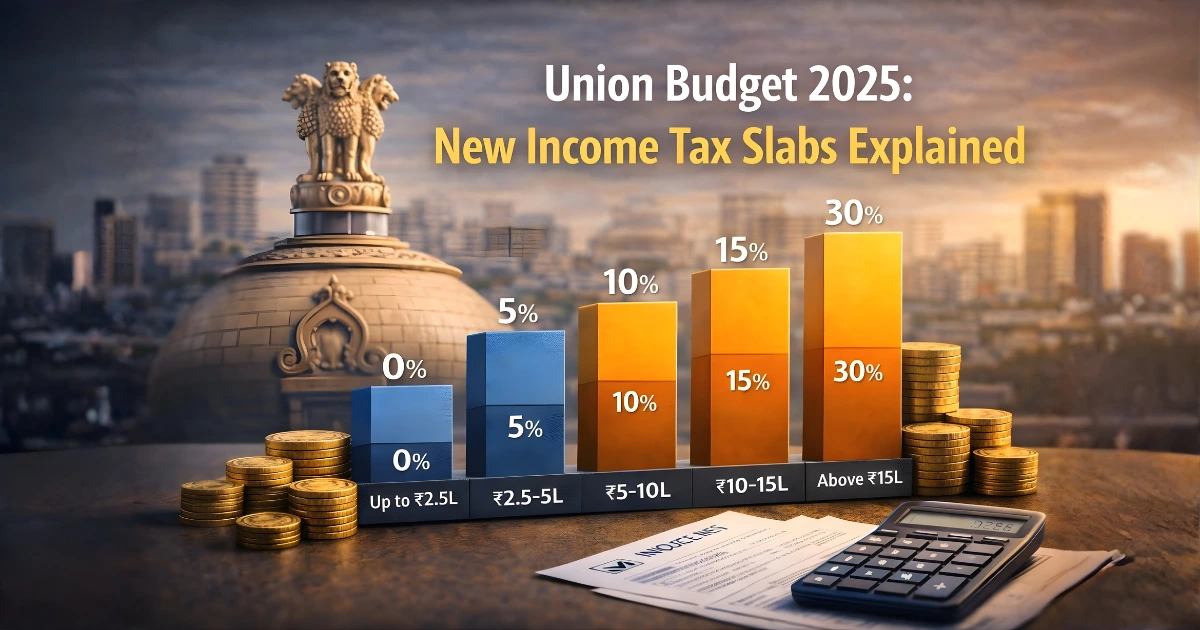

The Union Budget 2025, presented by Nirmala Sitharaman on February 1, 2025, introduced one of the most taxpayer-friendly changes in...

India is now the fastest-growing freelance market in the world. From consultants and designers to YouTubers, influencers, and content creators,...

Cryptocurrency taxation in India is no longer unclear or optional. Since the introduction of a definitive framework in 2022, India’s...

Corporate taxation in India is a critical responsibility for every company operating in the country. From determining the right tax...

Staying compliant in India requires more than awareness—it demands discipline and planning. With multiple tax, GST, and corporate filings spread...

Starting a business in India is exciting, but compliance is often where things go wrong. In the rush to build...