Most people don’t fail at saving because they earn too little.

They fail because their money has no structure.

In 2026, inflation isn’t dramatic—but it’s persistent. Groceries creep up. Rent renewals hurt. EMIs refuse to shrink. And somehow, despite earning more than before, savings still feel stuck.

This is exactly where the 50/30/20 rule earns its relevance.

Not as a fancy finance theory—but as a simple way to regain control when costs keep rising.

Let’s break it down in a way that actually works for Indian households today.

What Is the 50/30/20 Rule (In Plain English)

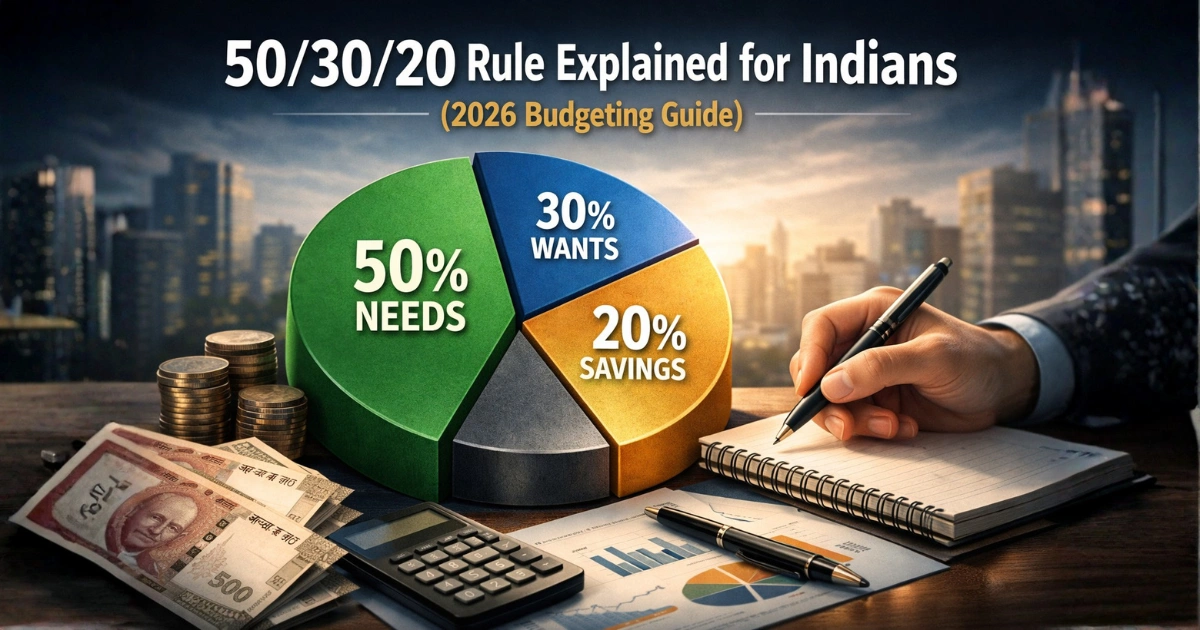

The 50/30/20 rule is a budgeting framework that divides your monthly income (after tax) into three buckets:

-

Needs (50%) – Essentials you can’t avoid

-

Wants (30%) – Lifestyle choices you enjoy

-

Savings & Investments (20%) – Your future safety net

In short, it divides after-tax income into needs, wants, and savings so money doesn’t disappear without direction.

This approach is widely referenced in global personal finance literature and explained in detail by platforms like

👉 https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

This rule isn’t about restriction.

It’s about clarity.

Needs (50%): The Non-Negotiables

Needs (50%) cover expenses that keep your life running. Miss them, and things break.

Typical Indian “needs” include:

-

Rent or home loan EMIs

-

Groceries and household supplies

-

Electricity, water, gas, internet

-

School fees or basic education costs

-

Insurance premiums

-

Transport to work

For context, Indian household spending patterns consistently show housing and food dominating monthly budgets, as highlighted in RBI’s consumer expenditure insights:

👉 https://www.rbi.org.in/Scripts/PublicationsView.aspx?id=20712

Real-life example

If your after-tax income is ₹80,000 per month, your needs budget should ideally stay around ₹40,000.

Here’s the hard truth for 2026:

In many cities, needs already exceed 50% due to rent inflation and fuel costs.

That doesn’t mean the rule is useless.

It means flexibility matters.

What to do if needs cross 50%:

-

Reclassify ruthlessly (Netflix isn’t a need)

-

Reduce fixed costs before cutting savings

-

Accept temporary imbalance—but fix it long-term

Wants (30%): Where Lifestyle Quietly Wrecks Budgets

Wants (30%) are not bad. They’re human.

They include:

-

Dining out and food delivery

-

OTT subscriptions

-

Vacations and weekend trips

-

Gadgets, upgrades, impulse buys

-

Gym memberships and hobbies

This is where most budgets silently fail.

Not because people overspend once—but because small wants compound monthly.

Digital payments and subscription-based spending have accelerated this behaviour, as highlighted in India’s digital consumption trends:

👉 https://www.mckinsey.com/industries/financial-services/our-insights/india-digital-payments

Reality check

₹299 here. ₹499 there. ₹2,000 on a “small treat.”

By month-end, your 30% quietly becomes 40%.

Smart move:

Set a hard cap on wants. When it’s gone, it’s gone.

Freedom feels better when it’s intentional.

Savings & Investments (20%): The Bucket That Changes Everything

Savings & Investments (20%) aren’t leftovers.

They come first.

This bucket includes:

-

Emergency fund contributions

-

SIPs in mutual funds

-

PPF, EPF, NPS

-

Direct equity (if you understand it)

-

Debt repayment beyond EMIs

If you’re unsure how to structure this bucket, SEBI’s investor education portal breaks down core investment options clearly:

👉 https://investor.sebi.gov.in/

In 2026, relying on “future income growth” is risky thinking.

Security comes from consistency.

Automate or fail

The easiest way to protect this 20%?

-

Auto-debit SIPs the day salary hits

-

Separate savings account (don’t touch it)

-

Treat investments like fixed bills

If you wait to save “what’s left,” nothing will be left.

Budget With the 50-30-20 Rule (Step-by-Step)

Here’s how to apply it without overthinking:

-

Calculate your after-tax income

-

Divide it into three buckets

-

Needs (50%)

-

Wants (30%)

-

Savings & Investments (20%)

-

-

Track spending for one month—no judgement

-

Identify leakages (especially in wants)

-

Adjust gradually, not overnight

If you prefer digital tracking, RBI-authorised budgeting and expense apps can help with visibility:

👉 https://www.rbi.org.in/Scripts/FAQView.aspx?Id=155

The rule shows you how to split your after-tax income into three spending categories—but you still control the execution.

Flexibility: The Rule Most People Ignore

The 50/30/20 rule is a framework, not a law.

In real Indian life:

-

Young professionals may save 30%

-

Families with EMIs may save 10–15% temporarily

-

Freelancers may need irregular adjustments

Flexibility is what makes the rule sustainable.

The goal isn’t perfection.

The goal is awareness + direction.

Common Mistakes Indians Make With This Rule

-

Treating wants as needs

-

Saving only when “extra” money appears

-

Ignoring annual expenses (insurance, school fees)

-

Not revisiting the split as income grows

-

Tracking mentally instead of on paper/apps

Budgets fail when they stay theoretical.

Pro Tips That Actually Work in 2026

-

Review the split every 6 months

-

Increase savings percentage with every raise

-

Cap lifestyle inflation intentionally

-

Build a 6-month emergency fund before aggressive investing

-

Keep needs boring and predictable

Money behaves better when rules are simple.

Final Thoughts: Why This Rule Still Works in 2026

Inflation hasn’t killed budgeting.

Confusion has.

The 50/30/20 rule works because it forces decisions early—before money disappears.

It divides your monthly income (after tax) into three buckets, gives you control, and leaves room to breathe.

Start imperfect. Adjust honestly. Stay consistent.

That’s how financial stability is built—quietly.